South Africa faced the closure of 109 businesses in January 2024, highlighting the pressing need for trade credit insurance to shield businesses against unpaid debts and navigate the turbulent economic landscape, offering a lifeline for businesses of all sizes grappling with the volatile market conditions.

A significant number of businesses in South Africa have faced dire consequences due to delayed or defaulted payments. These unpaid invoices often lead to cash flow constraints, hampering operations, hindering growth, and in some cases, forcing businesses to close their doors permanently.

In fact, Statistics SA reports that in January 2024, South Africa experienced the closure of 109 businesses. Their statistical release on liquidations, dated February 26, 2024, reveals a 34.6% rise in total liquidations for January 2024 compared to January 2023.

In the current volatile economic conditions, South African businesses, whether they are an SME, mid-market or a multinational organisation, must safeguard their b2b transactions against the threat of unpaid debts. As the country grapples with economic fluctuations exacerbated by global events, the importance of trade credit insurance cannot be overstated. This invaluable tool offers a protective shield for businesses, ensuring stability and mitigating risks in an unpredictable market.

Understanding trade credit insurance and how it works

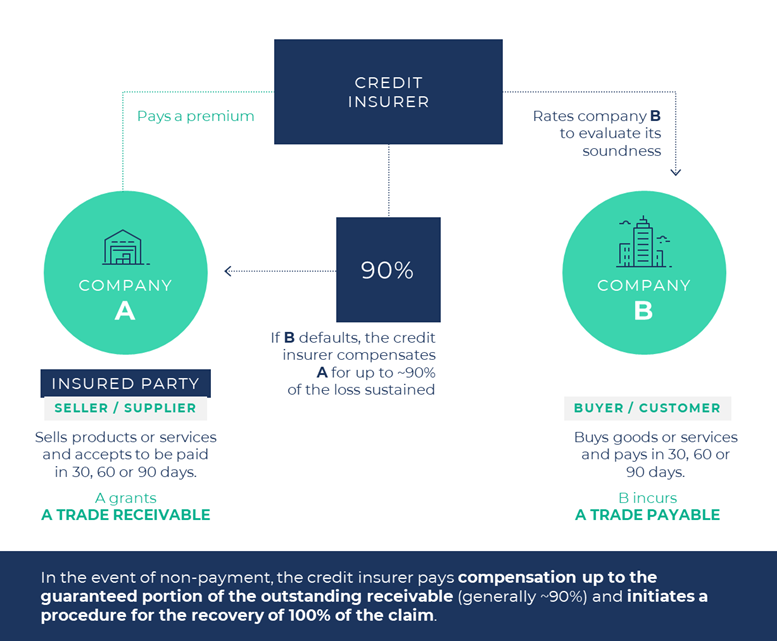

Trade credit insurance is a specialised insurance policy designed to protect businesses against losses resulting from unpaid trade debts. It allows companies to grant payment periods to their customers in South Africa and abroad with confidence. It also protects your invoices against excessive late payment or default by your customers. In short, when you insure your sales in South Africa or abroad, you protect your cash flow and preserve your margins. You also optimise the management of your business income and safeguard your growth.

Roger PEIXINHO, CCO at Coface South Africa, underscores the significance of trade credit insurance by highlighting its multifaceted benefits. "Trade credit insurance not only enhances cash flow management but also reduces credit risk, thereby enabling businesses to access financing more readily and expand their global trade footprint with confidence. Analysing the environment of your customers in terms of country/sector, together with their financial information, we can direct you towards solvent companies and freeze out bad debtors. This cuts down your unpaid debts which means your company works with the right partners." he explains.

Benefits of trade credit insurance

- It safeguards your cash flow: 1 in 4 companies go out of business due to non-payment by its customers. Securing your business against unpaid invoices means shielding your cash flow and growing your turnover without any worries. Business credit insurance is the only tool that protects the economy against bankruptcy chains and the job losses that go with them.

- It reduces credit risk: Trade credit insurance provides businesses with the assurance that they will be compensated in the event of customer default, thereby reducing the risk of financial losses.

- It improves access to financing: Credit insurance guarantees that you have optimised cash flow so you can meet once-off needs. It’s a sign of confidence that reassures your financial partners, helping you obtain future financing.

- It enables global trade expansion: For businesses engaged in international trade, trade credit insurance can facilitate expansion into new markets by mitigating the risks associated with cross-border transactions.

Leveraging business information also helps to mitigate risks

By harnessing the power of business intelligence and data analytics, companies can gain invaluable insights into the creditworthiness of their customers and partners, thereby minimising the risks associated with trade transactions and provides a competitive advantage against their competitors.

"In an era of heightened uncertainty, businesses also need to rely on data-driven insights to assess credit risks and protect their interests," PEIXINHO advises. "By harnessing advanced analytics and predictive modeling, companies can identify potential risks early on and take proactive measures to mitigate them."

By integrating robust risk management strategies with the latest technological innovations, businesses can enhance their resilience in the face of economic volatility. Whether it's monitoring market trends, assessing the financial health of counterparties, or identifying emerging risks, leveraging business information enables companies to stay ahead of the curve and safeguard their long-term success.

The impact of unstable debt collection

80% of businesses struggle to recover unpaid debts! The instability in debt collection aggravates the challenges faced by South African businesses. Non-payment can have a huge impact on your cash flow and performance. One in four bankruptcies are due to unpaid debt, and a single major debtor can weigh heavily on your business transactions… and even threaten your company’s survival. With a fragmented and often inefficient debt collection system, businesses are left vulnerable to the notions of non-paying customers. The tough process of chasing payments not only consumes valuable time and resources but also introduces additional uncertainties into the financial health of a company.

Empowering businesses with solutions

Trade credit insurance and business information offers a proactive and effective solution for businesses to mitigate the risks of unpaid invoices and unstable debt collection.

PEIXINHO says, “As we look to the future, it is imperative that businesses recognise the importance of protecting their income streams and securing their financial stability. By embracing trade credit insurance, businesses can fortify themselves against the uncertainties of the market, empowering themselves to thrive even in today's tough economic times. In partnership with trusted insurers like Coface, businesses can confidently navigate the complexities of trade, knowing that their interests are safeguarded, and their futures secured. It's time for businesses to take control and embrace the protection of trade credit insurance.”